|

Do you REALLY need to hire a forensic accountant for business valuation in your Texas divorce? The answer to this question isn't straightforward—it depends on your situation. However, here are some factors to consider that can help you make an informed decision.

Complexity of Your Business If your business is a straightforward operation, like a sole proprietorship with a single income stream, you might not need a forensic accountant. On the other hand, if your business is complex, has multiple income streams, or involves intricate financial instruments, a forensic accountant can be invaluable. Disagreements Over Value If you and your spouse can't agree on the value of the business, or if you suspect that there are undisclosed assets, a forensic accountant can provide an unbiased third-party valuation. They can dig deep into the business's financials to provide a more accurate and fair value. Community Property State Texas is a community property state, meaning assets acquired during the marriage are generally split equally in a divorce. If your business was started or significantly grew in value during your marriage, it's likely considered community property. A forensic accountant can help establish a fair division of these assets. Expert Testimony In contentious divorces, or those with significant assets at stake, expert testimony may be required. A forensic accountant can act as an expert witness, offering a credible valuation of your business that may be more convincing to a court than a simple estimate. Tax Implications Dividing a business can have significant tax implications. A forensic accountant with experience in divorce cases can help you understand potential tax burdens or benefits from various division scenarios. Due Diligence Even if you think you have a clear picture of your business’s value, the due diligence conducted by a forensic accountant can either confirm this value or reveal details that might significantly change it. This could be essential for ensuring a fair division of assets. Cost vs Benefit Hiring a forensic accountant can be expensive, but you should weigh this cost against the potential financial implications. If your business is high-value, or if there’s a large discrepancy in how you and your spouse view its value, the cost of an accountant may be a sound investment. Conclusion So, do you need to hire a forensic accountant for your Texas divorce? If your business is complex, if you and your spouse disagree on its value, or if there are substantial assets at stake, the answer is likely yes. In any case, consult your divorce attorney for personalized advice tailored to your unique situation. Remember, the stakes are high, and having an expert in your corner can make all the difference in achieving a fair division of assets.

0 Comments

Divorce has the potential to wreak havoc on your financial life—especially if you're a small business owner. Can a prenuptial or postnuptial agreement protect your business in a Texas divorce?

The short answer is yes, if it is done correctly. Let's delve into the specifics. Prenuptial Agreements A prenuptial agreement is a legal contract entered into by a couple before their marriage. This agreement outlines the distribution of assets, including business interests, in the event of divorce or death. In Texas, prenuptial agreements are generally honored as long as they meet certain requirements:

If these conditions are met, a prenuptial agreement can be an effective tool for protecting your business in a Texas divorce. It can stipulate that the business is separate property and not subject to division. Postnuptial Agreements Similar to a prenuptial agreement, a postnuptial agreement is a contract entered into by a couple after they are already married. While postnuptial agreements weren't always enforceable in Texas, changes in law have made them a viable option for protecting your business. Just like with prenuptial agreements, full disclosure of assets and liabilities, as well as the voluntary nature of the agreement, are key for enforceability. Community Property State Considerations Texas is a community property state, which means that all assets acquired during the marriage are considered jointly owned by both spouses and are subject to division in a divorce. However, a well-crafted prenuptial or postnuptial agreement can define your business as separate property, thus protecting it from being divided in the divorce. Final Thoughts While a prenuptial or postnuptial agreement can offer significant protection for your business, it's crucial to consult an experienced divorce attorney to ensure that the agreement is legally sound and enforceable. Every business and marriage is unique, and a one-size-fits-all approach rarely works when it comes to legal matters as important as protecting your livelihood. If you have questions about how to safeguard your business in a Texas divorce, don't hesitate to reach out to our expert team for personalized advice tailored to your situation. Navigating a divorce is complicated enough, but when you throw a small business into the mix, the stakes can feel incredibly high. One of the most common questions we hear from business owners considering divorce in Texas is, "Will my spouse be entitled to half of my business?" While the answer isn't a simple yes or no, there are several factors to consider that can provide clarity.

Community Property First, it’s important to understand that Texas is a community property state. This means that assets and debts acquired during the marriage are generally considered communal and are thus subject to division upon divorce. However, this doesn't necessarily mean a 50-50 split; rather, Texas law stipulates a "just and right" division of community property. Pre- or Postnuptial Agreements If you have a prenuptial or postnuptial agreement that addresses the business, this will generally dictate the division of assets. These agreements can protect a business from becoming a part of the marital estate if properly drafted and executed. Date of Business Establishment If the business was established before the marriage, it might be considered separate property, thus exempting it from division. However, the increase in value of the business during the marriage could be considered community property. Involvement of Spouse in the Business The level of involvement your spouse has in the business can significantly impact how it is divided. If your spouse has contributed to its success, whether financially or through labor, they may be entitled to a share in its value. Valuation of the Business Accurate business valuation is critical in determining how it will be divided. A forensic accountant or a business valuation expert is often hired to assess the true value of the business, considering various elements like assets, debts, revenue, and future earning potential. Possible Outcomes

Consult a Professional Divorce involving a small business is a complex matter, requiring expertise in both family law and business valuation. It is advisable to consult with an experienced divorce attorney who can guide you through this challenging process. If you have more questions or need expert legal advice, don't hesitate to reach out to us for a consultation. If you or your spouse own a small business and you're contemplating divorce, you're likely wondering how the business will be valued during the process. The valuation of a business in a divorce is a critical aspect that can significantly affect the division of assets. Here’s a detailed overview of the process.

Importance of Accurate Valuation An accurate business valuation is sometimes vital to ensure a fair division of assets in a Texas divorce. The valuation can influence spousal support, property division, and even child support in some cases. Both parties must agree on the value of the business, or else a court may have to intervene. A professional valuation by one or the other, or even both spouses as a joint venture may be critical step in resolving disputes about the division of the community estate. It is important to consult with an attorney experienced in cases involving closely held business interests. Owning a small business makes your divorce case more complex than others, and the reality may be that the community estate will have expenditures in processing your divorce that others do not. This includes the valuation of the business. Your attorney will help you in taking the right path in saving on the expenses of handling the division of closely held business, but also in getting effective results in Court from those investments. Here are some of the steps you and your lawyer may need to go through in valuing a small business. Step 1: Choose a Valuation Method There are multiple methods for valuing a business, but the most commonly used are:

Step 2: Hire Professionals For a high-stakes matter like this, it's often advisable to hire a professional like a Certified Business Appraiser or a forensic accountant specialized in business valuations. They can provide a more accurate and impartial valuation. Step 3: Collect Financial Records Your appraiser will need several years of income statements, balance sheets, and tax returns. The more complete and accurate this data is, the more precise the valuation will be. If you are the one running the business, you will likely have access to this information. If not, it will have to obtained through the process of discovery. Step 4: Analyze Cash Flow and Earnings Consistent earnings and positive cash flow generally increase a business's value. Your appraiser will examine these in detail. Step 5: Assess Intangible Assets Intangible assets such as brand reputation, customer loyalty, and intellectual property can also add value to a business and should be assessed. Step 6: Apply Discounts or Premiums Factors like majority ownership, market conditions, or specific operational risks can result in discounts or premiums being applied to the valuation. Step 7: Review and Finalize Once the draft valuation is complete, both parties should review it. If there's disagreement, additional negotiation or even court intervention may be necessary to finalize the valuation. Valuing a business in a divorce is a complex but crucial process that requires careful attention to detail and, often, the expertise of professionals. If you're going through a divorce and are concerned about your business, seeking qualified legal advice is paramount. Divorce is a complex and emotionally taxing process. If you own a small business, the stakes are even higher. Your business is not just a source of income; it's often a labor of love, years in the making. So, it's natural to wonder: how will my small business be affected by divorce?

Marital Property vs. Separate Property The first thing to consider is whether the business is considered marital or separate property. Generally, if the business was started during the marriage and both spouses contributed to its growth, it's likely to be considered marital property. In contrast, if one spouse owned the business before the marriage and kept it separate, it might remain separate property. Case law on this aspect is tricky and nuanced so consult your attorney for specifics as it relates to your situation. Business Valuation Determining the value of a business in a divorce can be a contentious issue. You may need to hire a forensic accountant or a business appraiser to establish the business's worth. This valuation will be critical when negotiating property division. Division of Assets The division of your business will depend on whether you reside in a community property state or an equitable distribution state. In community property states, each spouse is typically entitled to half of all marital assets, including businesses. In equitable distribution states, assets are divided based on a variety of factors like contribution to the marriage, the length of the marriage, and the needs of each party. Buyouts and Co-ownership If the business is marital property, one option is to buy out your spouse's share. This can be an expensive route, but it allows you to keep the business intact. Alternatively, some ex-spouses continue to co-own and operate the business together post-divorce, although this requires a strong working relationship. Spousal and Child Support Your business income could affect spousal and child support calculations. Higher business income may result in higher support payments, making it even more essential to get an accurate business valuation. Safeguarding Your Business There are ways to protect your business before divorce becomes a consideration. Prenuptial or postnuptial agreements can specify what happens to the business in the event of a divorce. Keeping clear financial boundaries between business and personal assets can also be helpful. Legal and Professional GuidanceDivorce involving a small business is often complex, and it’s advised to consult legal professionals who specialize in both family law and business assets. They can help you navigate the complexities and minimize the impact on your business. Divorce can have significant implications for your small business, but proactive planning and expert advice can help you manage the challenges. As each divorce is unique, you need to meet with an experienced divorce attorney to discuss the specifics of your situation. Remember, protecting your business means protecting your future, so make informed decisions guided by professional advice. The Dual Role of Divorce Attorneys and Mental Health Professionals: A Holistic Approach to Divorce8/30/2023  Introduction Divorce is never an easy decision or process. It’s not just about separating lives on paper; it involves a complex web of emotional, financial, and legal entanglements. And just like treating a serious illness, you need a comprehensive team for a complete and healthy recovery. In the context of divorce, that means partnering with both an expert divorce attorney and a qualified mental health professional. The Surgeon: Your Divorce Attorney Think of your divorce attorney as a surgeon. When you're dealing with a severe illness, you want a surgeon who employs the sharpest tools, who cuts deftly, judiciously, and precisely to remove unhealthy tissue. A good divorce attorney functions in much the same way. Their role is to dissect the failing aspects of the marriage in the most effective way possible, addressing property division, child custody, alimony, and more. No surgeon can promise a completely painless process, and neither can a divorce attorney. However, what they can and should offer is a commitment to minimize the harm their necessary work inflicts. They need to be just aggressive enough to effectively "cut out all the disease," ensuring that you have the best chance of a full legal recovery without relapse. The Mental Health Professional: Your Emotional Healer But cutting away the "disease" is only half the cure. After the surgery comes the delicate process of suturing the wounds and promoting regenerative growth. In the landscape of divorce, this is where mental health professionals come into play. Therapists, counselors, or psychologists can help you navigate the emotional challenges that inevitably arise during a divorce. They are the ones who "stitch you back up," metaphorically speaking, helping to heal emotional wounds, offer coping strategies, and provide emotional stability. Why You Need Both Much like how medical treatments often require both surgery and postoperative care for holistic healing, a smooth divorce process and a healthy new chapter in life necessitate the expertise of both a divorce attorney and a mental health professional. The attorney ensures your legal rights and financial assets are protected, while the mental health professional aids in your emotional and psychological well-being. Ignoring either aspect can lead to incomplete recovery. Legal missteps can have long-term consequences, just as emotional wounds can fester if not properly addressed. Taking a Holistic Approach Divorce is a multi-faceted challenge that requires a multi-disciplinary approach. Think of your divorce attorney as the surgeon, tasked with the necessary but difficult job of cutting away the failing parts of your marriage. Yet, also remember that healing is a two-part process. The suturing and emotional healing that are equally crucial in the long run fall under the domain of a qualified mental health professional. By understanding and employing the roles of both these experts, you stand the best chance at a full, healthy recovery, legally, emotionally, and psychologically.  As a Texas attorney with two decades of experience exclusively in family law, I am always on the lookout for things that can positively impact the lives of my clients as they go through the painful process of divorce. And it's not often that I can find positive impact from the actions of the Texas Legislature. But recently, the "Distinguished Gentlepersons" up in Austin got something right. A small change to the Texas Family Code caught my attention, and I believe it will greatly improve the timely relief of temporary matters in divorce litigation. For those curious about such matters, here are the details of this new provision and what I believe will be the positive impact it will have for couples navigating the challenging waters of divorce in Texas. The New Provision: With the passage of Texas House Bill 2671, beginning September 1, 2023, the Texas Family Code will now include § 105.001(a-1), which addresses Temporary Orders in family law matters. This newly added subsection offers a solution to a common problem faced by divorcing couples: the delay in obtaining temporary relief due to referrals to mediation. The Change: Before this change, when a court referred a divorce case to mediation and a motion for a temporary order was pending, the initial hearing on that motion could be postponed to a later date (sometimes a much later date of 60 days or more), leading to unnecessary delays in resolving urgent matters. However, the new provision brings an essential safeguard into play. Under § 105.001(a-1), if the court, on its own motion, refers a suit for mediation where a motion for a temporary order is pending, the court cannot postpone the initial hearing on that motion beyond the 30th day after the original hearing date was set. This means that once a motion for temporary relief is filed, the court must address the matter and hold the initial hearing within 30 days. Enhancing Timely Relief: The implications of this change may not seem profound to most, but I believe it will mean the world of difference to people who are suffering in untenable domestic situations that need quick relief . Divorce cases often involve pressing issues such as child custody, temporary support, and property matters. Couples require swift resolution to these matters to maintain stability during the divorce process. By mandating an initial hearing within 30 days of filing the motion, this new provision ensures that temporary matters are addressed promptly. Moreover, the change promotes efficient case management and streamlines the divorce process for both parties and the court. Timely resolution of temporary matters can alleviate stress and uncertainty, allowing individuals to focus on moving forward with their lives. The addition of 105.001(a-1) to the Texas Family Code marks a small but significant step forward in enhancing timely relief of temporary matters in divorce litigation. As a family law attorney, I believe this change will have a positive impact on divorcing couples, offering them the assurance that urgent issues will be addressed promptly. Moreover, the provision reflects a commitment to efficient case management and the well-being of those navigating the complexities of divorce. The prospect of getting a divorce can be daunting, and even more so if you own a small business. When a marriage ends and both parties own a business, it can be complicated to navigate the legal and financial aspects of a divorce. What are are the top considerations for small business owners facing divorce?

Whether you are considering filing for divorce, or your spouse has already initiated the divorce process, there’s important considerations when a small business is part of the equation. If you're a business owner and one or both of you are seeking a divorce, there are some particular points of concern that you need to keep in mind. First and foremost is the value of the business itself. The court may order an appraisal of the business to determine what the fair market value is. This is so each party can receive an equitable share in the assets. If one of you was the sole owner of the business prior to marriage, the court may decide that ownership of the business isn’t subject to division but the increased value of the business is. Another point to consider is how much of your time and resources the divorce process will take up. Divorce can impact how much time and attention you can put into your business, as well as how smoothly operations run while the divorce is underway. It’s important to make sure that both parties understand their respective roles in the business during the divorce proceedings. If one or both spouses are also employed by the business, those roles need to be specified in order to ensure that everyone remains in compliance with any court orders that may be issued. If you are considering filing for divorce and are a small business owner, it’s important to seek professional counsel on how best to protect your rights and interests in the process.  Whether or not you should move out before filing for divorce depends on your individual situation. There are pros and cons to each option and the right decision varies greatly depending on you particular situation. For example, if you are seeking custody of your children, leaving the home without them will put you in a significant disadvantage when the actual custody proceedings begin. However, If you're experiencing conflict or abuse in the home, moving out may be necessary for your safety and wellbeing. In such cases, you may want to seek a protective order from the court to ensure your safety. On the other hand again, moving out before filing for divorce could impact your legal rights and obligations related to property division, and spousal support. If you move out and your spouse stays in the marital home for longer than a year, it could be interpreted as abandonment, which could weaken your legal position in the divorce proceedings. It's best to consult with a qualified family law attorney to understand the implications of moving out before filing for divorce in your jurisdiction.

No fault divorce has been in place since the 1970s and is currently recognized in all fifty states. This type of filing allows couples to obtain a divorce without having to prove that adultery, abandonment, cruelty, or other legally defined causes happened during the marriage. But a new effort by the Texas Republican Party is underway to end no fault divorce in the state of Texas. This would potentially be a major shift in the way divorce is handled in this state—shifting from an arrangement where couples can file for divorce based on irreconcilable differences, to an arrangement requiring a “fault” to be found before a divorce would be granted.

The opposition to reinstating fault based divorce stems from a concern regarding how the changing of the law would impact alimony and child support payments. Opponents are also worried that with the added difficulty of having to establish fault in each divorce suit, parties and certain lawyers may be incentivized to falsify evidence and create untruthful accounts of the relationship, which would lead to a longer and more costly divorce process. The Republican Party believes that the disadvantages of no fault divorces pale in comparison to the advantages that would come from requiring fault in court. They are hopeful that this change would allow couples to look back on their relationship and learn from their mistakes, leading to better communication, more understanding and less co-parental struggles. From a Texas divorce attorney perspective It CAN be difficult, but by no means impossible-to prove fault grounds- provided of course, the grounds are supported by facts. I take exception that some opponents to the bill cite that it can be presumed that divorce lawyers will allow false evidence into the Courts. Certainly there are some in this profession who may be dishonest, but most of the Texas bar is composed of honorable individuals who take their role as officers of the Court very seriously and would not allow falsehoods to be presented as truth- even to obtain a divorce. On the otherhand, there is no doubt that the bill would lead to more intensively fact based cases which certainly would create more lengthy and expensive legal battles in court. But the Republican Party may see this as a positive outcome because the increased litigation cost could create a further disincentive for couples to get a divorce. Although this proposal would potentially change the way divorces are handled in the state going forward, it’s important to note that no fault divorces still remain legal in Texas, but this proposed change would make them more difficult to obtain.  The practice of marrying is ancient, as marriages have been found to have existed in many cultures and civilisations as far back as 4,000 BC. Early marriage was often more of a business transaction than a personal choice, with parents arranging marriages for their children in order to gain wealth or form alliances with other families. The definition of marriage has changed over the centuries. From its earliest incarnation, marriage was seen as a way for two people, who were not necessarily in love, to join together to create a family. It was also believed to be a way of ensuring that the children had a stable home life. Over time, the emphasis changed, and marriage came to represent a union between two people who loved each other and wanted to create a family together. In addition to the definition of marriage changing, so has its structure. In the past, it was quite common for people to marry more than once in their lifetime; with widows or widowers being expected to remarry as soon as possible. As society has progressed, this is much less common. Marriage is now seen as a lifelong commitment between two people, and divorce is seen as an accepted part of life. Marriage continues to be a legal and social institution today, but it increasingly viewed as something that couples choose to do, rather than something that is expected of them. Marriage provides both legal and social benefits for couples, such as taxation breaks and insurance coverage. More than ever, people are looking beyond the traditional view of marriage and looking for new ways to express their commitment to each other. The legal landscape surrounding divorce is complex, and even more so when assets and children are involved. This article will explore a particular Texas case, "In re Marriage of Moncur, 640 S.W.3d 309, 316 (Tex.App.--Houston [14th Dist.] 2022, no pet." and discuss its implications on mediated settlement agreements (MSAs) under Texas Family Code Section 6.602. This case serves as a critical example of the complexities that can arise in divorce proceedings and the limitations of MSAs. Case Overview Leticia G. Moncur and Ross S. Moncur, who were married in 2002 and have a daughter, entered into a mediated settlement agreement (MSA) as part of their divorce proceedings. Leticia later claimed that Ross had fraudulently induced her to sign the MSA by not disclosing certain community property assets either before or during the mediation. The trial court, however, affirmed the MSA. What is Texas Family Code Section 6.602? Before we delve into the specifics of the case, it's essential to understand the framework of Texas Family Code Section 6.602. This section lays out the requirements for an MSA to be binding, which includes a prominently displayed statement that the agreement is not subject to revocation, signatures from each party, and signatures from the parties' attorneys if present during the signing. How Does the Moncur Case Relate to Section 6.602? The Moncur case brings up a challenging issue: Can an MSA be set aside if one party claims it was procured through fraud? Leticia alleges that Ross had a duty to disclose all financial accounts, asserting that he deliberately failed to do so. However, according to Section 6.602, the MSA met all the statutory requirements to be binding, and Leticia even conceded this point during the appeal. The Argument for Fiduciary Duty and Fraud by Non-disclosure Leticia argued that Ross had a fiduciary duty to disclose all material facts because they were married. While it's true that marriage creates a fiduciary relationship, this fiduciary duty dissolves when each spouse is independently represented by counsel in contested divorce proceedings, according to Texas case law. Additionally, she claimed that Ross had committed fraud by non-disclosure, a subcategory of fraud that occurs when a party deliberately fails to disclose material facts. To establish fraud by non-disclosure, several conditions must be met, including a pre-existing duty to disclose these facts. However, the court found that Ross did not have such a duty at the time of the MSA. The Importance of Context in Partial Disclosure One of the significant points raised in the case was the concept of partial disclosure. The court emphasized that without proper context, it's impossible to know whether partial disclosure created a false impression that necessitated full disclosure. Conclusion The Houston appeals court refused to set aside the MSA on the ground of fraudulent disclosure and represent a sting of similar cases where the Courts have refused to overturn mediated settlement agreements. The Moncur case emphasizes the importance of understanding that MSAs are tantamount to court rulings and will be overturned only in the most extreme of attacks on their validity. Parties should be exceedingly careful when entering into such agreements and be fully aware of the information being disclosed—or not disclosed—as an MSA, once entered is for most situations irrevocable.  In the realm of family court, particularly in custody battles, many fathers report feeling sidelined due to perceived gender bias. They often enter the court system expecting impartiality, as prescribed by law, only to discover that the deck seems stacked against them. This is a concern that gains gravity when considering the gender imbalance in various court roles—from judges and clerks to hearing officers. Roots of Perceived Gender Bias in Family Courts To understand why this bias is perceived, we need to delve into traditional family roles and their impact on the family court system. In a conventional family setup, men are usually seen as the providers, while women are considered the primary caregivers. These roles naturally evolve in many families, with mothers taking the helm on tasks like scheduling doctor's appointments, handling school matters, and daily childcare. Fathers, conversely, focus on providing financial support and may not be as involved in daily caregiving activities. Texas case law echoes the sentiment that the court's focus is on the "best interests of the child." Specifically, in the case of In re McLean, 725 S.W.2d 696, 698 (Tex.1987), the court underlines that child custody decisions are guided by what best serves the child's well-being. This principle is also emphasized in In re M.S.F., 383 S.W.3d 712, 716-17 (Tex.App.--Amarillo 2012, no pet.). Often, however, the "best interests" criteria can inadvertently align with traditional gender roles, disadvantaging fathers. For instance, a father who does not know the date of his child's next doctor's appointment may be judged as less competent in parenting, irrespective of the division of roles in the family. Furthermore, Texas Family Code Section 153.003 explicitly states, "The court shall consider the qualifications of the parties without regard to their marital status or to the sex of the party or the child in determining [...] which parent to appoint as sole managing conservator." While the law prescribes impartiality, its practical application can sometimes deviate, reflecting societal norms and expectations. Preparing for Custody Battles: Strategies for Fathers Given the landscape, it's critical for fathers to be proactive if they suspect that they might encounter bias in court. Here are some crucial steps:

By thoroughly understanding both the judicial perspective, as underlined by case law and statutes like Texas Family Code Section 153.003, and by taking preemptive action, fathers can better position themselves in what may feel like an uphill custody battle. While perceived gender bias may not be entirely eliminated overnight, knowing how to navigate the system can make a significant difference in the outcome of your case.

Most people known that in the United States, Divorces occur in about 50% percent of first-time marriages. But did you know that statisics show that for subsequent wedding vows, 67% of second marriages, and 74% of third marriages end in divorce? Why do second or third marriages fail so often?

You’d think one would get ‘better’ at the whole marriage thing with more practice. And whatever happened to third time’s a charm? With each waltz down the aisle, surely the bride and groom both think- “this time I got it right, this is the real thing, this is unshakable, this the marriage that will beat all odds..” But even if you picked right, sadly the deck is stacked against you from the get-go. Turns out, there are many reasons why second and third marriages fail. If you are contemplating remarriage, be aware of these stumbling blocks. Why Second and Third Marriages End in Divorce 1. Been There, Done That, and Survived If someone has been through a divorce once, and knows they can make it through this tragic, life-altering ordeal, then maybe they're less terrified of going through it again when the you-know-what hits the fan. The thought process might be “I’ve done it once, lived to the tell the tale, and can survive it….again.” They may also be more inclined to run at the first sign of trouble. So, it’s not that one gets better at marriage with every marriage, it’s that one gets better at divorce with every marriage. 2. Divorce Baggage Having been through a wrenching emotional experience, one might be wary of fully opening their heart to a new love. Someone may think they are over their divorce, but deep down, at the subconscious level, their wounds are still raw. A fear of intimacy- getting too close- leaves them scared of giving their all. Vulnerability reminds them of the pain from the divorce. Always expecting the worst, being a ‘Debbie Downer’, with doomsday around every corner is not healthy for the new relationship. A "glass-half-empty" attitude can become a self-fulfilling prophecy. Carrying the same emotional baggage, and pain, from one relationship to another is without a doubt, poisonous. Sometimes divorcees get TOO set in their ways of independence, especially if they have been divorced for a long while. If someone's not willing to fully merge their life with yours, the marriage will be difficult to sustain. Make sure everyone going into the new marriage is emotionally healed, healthy, and really ready for a fresh start. 3. Marrying for The Wrong Reasons Feeling lonely, or feeling like one just can’t hack it alone, can lead to hasty decisions. Reentering into coupledom, without clearly thinking things through in a mature manner, sets a marriage up for failure. Rebounding is quite common, as the attention from another suitor can be very intoxicating. But running from one relationship to another, without giving it proper time and assessment is dangerous. Once the infatuation wanes, the reality of the relationship may not be as rosy without those rose-colored glasses. 4. Not Enough Time Spent Getting to Know Someone It’s important to get to know someone in ALL aspects of life before marrying them. No one is ALWAYS the best version of themselves, and it’s important to see someone when they aren’t at their best – see how they handle stress, criticism, bad luck, tough times, rejection, and failure. How are they are resolving problems dealt to them not just by themselves, but dealt with as a couple? Without taking the time to see the whole person – the good, the bad, and the ugly – one won’t get the chance to properly evaluate their new mate before making a major life decision.. Like marriage. This applies equally to first marriages and every marriage after. 5. Kids as the Common Glue Perhaps the cement holding a 2nd/3rd/4th marriage together isn’t as strong. Marriage, historically and as an institution, was mainly intended as a structure for raising offspring. Since most subsequent marriages don't produce children, there is no common glue binding them together. Couples won’t be as inclined to ‘work it out, for the children’s sake’ when things get rough. Many often sacrifice their own happiness and stay in a (first) marriage way past its expiration date. Everyone knows at least one couple who waited until the kids left off to college to divorce. As hard as kids are to raise, and as tough as they can be on their parents, they act as a stabilizing influence in marriage. Furthermore, without children in common, the element of family is not as fundamental. So, the desire to keep the family together is not as strong. Simply put, there is less at stake in allowing a marriage to dissolve when little children hearts aren’t a factor. 6. Second Marriages come with Stepchildren. While children act as binding agents in first marriages (even rocky ones), stepchildren are often the dissolving agents in subsequent ones Children from a prior marriage make subsequent marriages even more complicated. The more children the more complications. Learning to live with other people’s children isn’t easy, Plus, children often harbor resentment for their parent’s new spouse and will go out of their way to make things difficult. This is the "evil step-mother or father" syndrome. Children heal from divorce at different rates, some faster and easier than others. Many fantasize about their parents getting back to together for years. They mourn the loss of their family and often aren’t welcoming to new step-parents or step-siblings. They view them as obstacles to mommy and daddy getting back together. Furthermore, stepparents usually don't have the power to be a disciplinarian, and find themselves in the difficult position of having to bite their tongues. They often feel walked upon by their partner’s children, disrespected in their own home, with not much they can do about it. It takes patience, time, and intense communication to make the new, blended family run smoothly. 7. The Ex-Factor Then there are exes to cooperate with. So basically, as more and more characters join the blended family, the crazier the circus gets. Juggling these relationships can cause problems and generate animosities, further complicating the new family dynamic. Some exes are less than thrilled to see their ex enter a new marriage—and when they hear of it, it brings to the surface unresolved emotions. Some angry exes continue to drag their ex-spouse back to court for various (often petty) reasons long after the divorce is final, just because they can. And these especially crop up when their spouse marries again. Some exes may thrive on attempting to sabotage your new relationship every chance they get. These off-the-wall, ill-intended actions do cause serious emotional and financial strife in the new marriage. Even worse, they may use children as a ploy in combat against you and your new partner …yes – it’s very sad, and yes – very stressful. 8. Money Matters Money is often an issue in first marriages but becomes even more pronounced in second/third marriages due to child support and other financial obligations. Money and resentment go hand in hand in second/subsequent marriages, and can especially feel the strain when money is tight. And issues only compound when bringing in debts you didn't help create. In general, money matters tend to bring out a lot of ‘feeling’ in people. Maybe one spouse harbors resentment that much of their new spouse’s money is going toward child rearing expenses for children that aren’t theirs. Many couples contemplating a second marriage don't have honest and frank discussions about these issues because they seem petty or unfair at the time, but small unresolved emotions and grow into large resentments over time which will drive a wedge between the couple. 9. Complicated Family Matters & In-Law Situations In-laws, and extended family in general, are difficult enough. In-Law relations, family past and present, become especially challenging in subsequent marriages, particularly when both spouses bring children into the new marriage. The cast of characters would include husband’s parents, wife’s parents, husband’s ex’s parents, and wife’s ex’s parents… then throw in a few shady cousins, weird uncles, and obnoxious aunts. Whose house do you go to for Christmas? Then, two of these in-law couples could be divorced as well, adding yet another pair of in-laws. Like cells they just keep breaking off, replicating, and expanding. If one of the spouses in a third marriage has children from their previous two marriages, the mathematic variation of potential extended-family complications just boggles the mind. 10. Failure to Plan Ahead If you are contemplating re-marriage, it’s best to go in bright-eyed and but also with your eyes opened wide. Be wary of these many pitfalls and deal with any issues head on. A great way of avoiding a lot of these pitfalls is having frank discussions with you intended second or third spouse BEFORE you tie the knot. Set common goals and make them specific. Speak with your accountant and set up a financial plan for your new family. A great way to gather your thoughts together and be sure you have agreements BEFORE they become problems is to develop a PRE-NUPTIAL agreement with an experienced family law attorney.  Recently passed HB 867 & 851 will put limits on the amounts individuals seeking to modify the amount of maintenance (aka "alimony") a former spouse will be able to get. The new law, which takes effect on September 1, 2021, says that an individual "may not increase maintenance to an amount or duration that exceeds the amount or remaining duration of the original maintenance order." (TFC 8.057(c)). The new law essentially makes it impossible to increase the amount of court-ordered maintenance in the future and makes it impossible to extent the period of the maintenance award. This is yet another example of how disfavored the concept of post-divorce payments to former spouses is in Texas. Also, this change in the law should be carefully observed by parties who are contemplating contractual alimony and who may be considering a lesser amount in the hopes they can modify it to a higher amount in the future. Do not believe anyone who tells you that you can always ask for more in the future. This new law will prevent that. What you agree to now ,in both amount and duration, will remain the most you can get through the Texas courts. Also note that this new limitation applies regardless of whether the order was rendered before, on, or after September 1, 2021. If you are involved in, or a thinking about, a League City divorce and you have any questions about spousal maintenance, please reach out to us. If you are finalizing your divorce soon, you'll want to pay attention! HB 3772 has passed and has changed the law on final decrees of divorce in Texas.

Starting September 1, 2021 there is an additional requirement that must be included in your final decree. All final decrees in the State of Texas must now include the date of marriage. Texas Family Code 6.712 states: (a) In a suit for dissolution of a marriage in which the court grants a divorce, the court shall state the date of the marriage in the decree of divorce. However, this requirement is not required in the case of divorces of informal marriages ("common law marriages"). The new law provides: (b) this section does not apply to a suit for dissolution of a marriage described by section 2.401(a)(2). If you are experiencing a League City Divorce or need to consult with a League City attorney for any other family law related matter, feel free to reach out to us. -Sean On Saturday, July 10, 2021, the Galveston County Justice Center at 600 59th Street in Galveston, Texas experienced a small fire, which though contained to a small area, produced water damage in several Courts and other facility areas.

The latest update is that the repairs and renovations to the facility are expected to take a couple of months before the facilities are fully functional. Beginning Monday, July 19, 2021, the District Courts and County Courts at Law will resume their court dockets. The County Courts at Law will have exclusive use of the constitutional courtroom on the fourth floor to conduct daily court operations on designated days. The District Courts will utilize the three unaffected courtrooms on the fourth floor on a rotating schedule. All courts have agreed that criminal defendants are not required to appear in person until August 9, 2021. The misdemeanor jail docket will continue to be held in the afternoons at 1:00 PM. The family associate judge’s docket will resume on Monday, July 26, 2021 in the jury assembly room on the first floor of the Justice Center. The hearings for this past week and next week will be rescheduled by court coordinators. All Justice Center jury trials are suspended until the week of September 27, 2021. In this video, family law attorney Sean Palmer discusses what a Financial Information Statement is, and its importance during divorce. The Palmer Law Firm Serving the Greater Houston to Galveston areas (832) 819-3529 thepalmerlawfirm.com fb: @thepalmerlawfirm t: @palmerlawfirm In this video, family law attorney Sean Palmer discusses pregnancy and divorce, and how you can get immediate temporary relief from the Court. For more information, see our handy infographic below the video! The Palmer Law Firm Serving the Greater Houston to Galveston areas (832) 819-3529 thepalmerlawfirm.com fb: @thepalmerlawfirm t: @palmerlawfirm One of the most pervasive questions I get is whether a party can record conversations either in person or on the phone. Here is a short breakdown of applicable laws and cases in Texas.

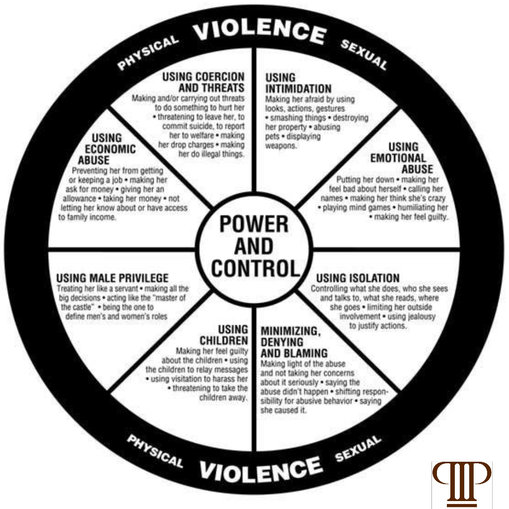

The General Rules: No matter the form of communication, the general rule is - assuming you aren't doing it for an illegal reason (harassment, etc.) - if you are recording a communication between yourself and another person, and the other person knows you are recording it, you are probably alright in recording it. If you are recording a conversation with another person who DOES NOT know you are recording it, you MAY (and I stress MAY) be ok to record it under certain circumstances. BUT, if you secretly record a conversation between two other people without their knowledge, that is classic wiretapping and you most likely will get in very big trouble. There are many exceptions and precautions to these general rules! Summary of statute(s): An individual who is a party to either an in-person conversation or electronic communication, or who has the consent of one of the parties to the communication, can lawfully record it, unless the person is doing so for the purpose of committing a criminal or tortious act. A person also can lawfully record electronic communications that are readily accessible to the general public. Tex. Penal Code Ann. § 16.02 (Vernon 2011). In-person conversations: The consent of at least one party to a conversation is required to record an “oral communication,” which is defined as “any oral communication uttered by a person exhibiting an expectation that the communication is not subject to interception under circumstances justifying that expectation.” Tex. Code Crim. Proc. Ann. art. 18.20. Thus, an ex-wife can record a conversation with her ex-husband at a Starbucks because she does not need consent to record conversations in public where there is no reasonable expectation of privacy. However if she records the same conversation in the privacy of the home, where privacy is usually expected, then she should get the ex-spouses permission before recording or she may be breaking the law. Electronic communications: Things can get VERY SERIOUS when recording electronic communications because Federal Wiretapping Laws may come into play. The consent of at least one party to any telephone communication is required to record it. And because the provision of the statute dealing with wireless communications applies to “a transfer of signs, signals, writing, images, sounds, data, or intelligence of any nature,” consent likewise is required to disclose the contents of text messages sent between wireless devices. Id. The burden will be on YOU to prove that you obtained informed consent prior to recording. Either have the consent given verbally and plainly at the beginning of the recording and/or get it in writing. Hidden cameras: It is a felony to photograph or record a person without the person’s consent in a public place “with the intent to arouse or gratify the sexual desire of any person,” or in a bathroom or private dressing room “with the intent to invade the privacy of the person, or arouse or gratify the sexual desire of any person,” and to disclose any images obtained by these means. Tex. Penal Code Ann. § 21.15. The law, however, does not criminalize the use of recording devices for other purposes in areas to which the public has access or there is no reasonable expectation of privacy (i.e., filming conversations on public streets or a hotel lobby). The state’s highest court for criminal cases recently held that the statutory prohibition on photographing or videotaping a person in public without that person’s consent with the intent to arouse or gratify a sexual desire did not implicate, much less violate, a defendant’s free-speech rights because the statute was not a regulation of speech or the contents of a visual image but rather a regulation of the photographer’s or videographer’s intent in creating the image. Ex parte Nyabwa, 366 S.W.3d 710 (Tex. Crim. App. 2012). Criminal penalties: Illegally recording an in-person conversation or electronic communication is a felony offense. Tex. Penal Code Ann. § 16.02. Civil suits: Anyone whose wire, oral or electronic communication has been recorded or disclosed in violation of the law can bring a civil suit to recover $10,000 for each occurrence, actual damages in excess of $10,000, punitive damages, attorney’s fees and court costs. Under the statute, an aggrieved person also is entitled to an injunction prohibiting further unlawful interception or disclosure. Tex. Civ. Prac. & Rem. Code Ann. § 123.004. Disclosing recordings: Not only can you get in serious trouble for illegally recording a communication, if you then show the illegal recordings to anyone, you may be breaking additional laws. Trying to get your attorney to listen to, watch or hold on to such illegal recordings counts. And then if your attorney tries to use illegal recordings in court, you BOTH can be violating the law. Disclosing the contents of a wire, oral or electronic communication obtained through illegal recording is a felony. Tex. Penal Code Ann. § 16.02 The bottom line The bottom line is that if you plan to record conversations without informing everyone that you are recording them, then make sure you follow these guidelines: 1. There are no circumstances when you can record a person for an illegal purpose such as to harass them or for sexual gratification. 2. At least one party to the conversations needs to be aware they are being recorded; 3. Do not record someone when they should reasonably expect privacy (such as in their home); 4. If you have an illegal recording in your possession, do not try to show it to anyone. It is best to consult with a lawyer before attempting to do any sort of fact gathering on your case. If you have any further questions about taping phone calls, recording conversations or taking videos in relation to your family law case in Texas you may schedule a consultation with an attorney on our website at thepalmerlawfirm.com. In this video, family law attorney Sean Palmer explains the key Texas Supreme Court case on which Texas judges rely whenever they are looking at how to review the best interests of a child. The case is Holley v. Adams, a 1976 case that for the first time, gathered and listed the basic issues that may be presented in court when arguing a case involving the “best interest” of a child. You can learn more at our video about the Fit Parent Presumption. Mr. Palmer also explains that these factors alone may not be enough, especially in close custody cases and what litigants should do to improve their chances of winning a Texas custody case. The Palmer Law Firm 303 E. Main Street, Suite 230 League City, Texas 77573 (832) 819-3529 thepalmerlawfirm.com fb: @thepalmerlawfirm t: @palmerlawfirm Domestic violence and abuse stems from a desire to gain and maintain power and control over an intimate partner. Abusive people believe they have the right to control and restrict their partners, and they may enjoy the feeling that exerting power gives them. They often believe their own feelings and needs should be the priority in their relationships, so they use abusive tactics to dismantle equality and make their partners feel less valuable and deserving of respect in the relationship.

No matter why it happens, abuse is not okay, and it’s never justified. Abuse is a learned behavior. Sometimes people see it in their own families. Other times they learn it from friends or popular culture. However, abuse is a choice, and it’s not one that anyone has to make. Many people who experience abuse growing up decide not to use those negative and hurtful behaviors in their relationships. Additionally, drug or alcohol addiction can often escalate abuse, but these issues do not cause abuse. Who Can Be in an Abusive Relationship? Anyone can be abusive relationship, and anyone can be the victim of abuse. It happens regardless of gender, age, sexual orientation, race or economic background. If you are being abused by your partner, you may feel confused, afraid, angry and/or trapped. All of these emotions are normal responses to abuse. You might also blame yourself for what is happening, but you are never responsible for your partner’s abusive actions. Being abusive is a choice; it’s a strategic behavior the abusive person uses to create their desired power dynamic. Regardless of the circumstances of the relationship or the pasts of either partner, no one ever deserves to be abused. Resources If you need immediate help, dial 911. You may also call the National Domestic Violence Hotline at 1-800-787-3224. If you live in Harris or Galveston Counties and need help obtaining a protective order, divorce or any other family law assistance, you can get more information by calling The Palmer Law Firm at (832) 819-3529. The Palmer Law Firm 303 E. Main St., Suite 230 League City, Texas 77573 (832) 819-3529 thepalmerlawfirm.com FB: @thepalmerlawfirm twitter: @palmerlawfirm |

Need more information about this or other family law topics in Texas?

Click the button below to book a FREE ATTORNEY CONSULTATION (832) 819-3529

Attorney Sean Y. Palmer has over 20 years of legal experience as a Texas Attorney and over 25 years as a Qualified Mediator in civil, family and CPS cases. Palmer practices exclusively in the area Family Law and handles Divorce, Child Custody, Child Support, Adoptions, and other Family Law Litigation cases. He represents clients throughout the greater Houston Galveston area, including: Clear Lake, NASA, Webster, Friendswood, Seabrook, League City, Galveston, Texas City, Dickinson, La Porte, La Marque, Clear Lake Shores, Bacliff, Kemah, Pasadena, Baytown, Deer Park, Harris County, and Galveston County, Texas.

Call (832) 819-3529 If you live in the Houston area and would like to consult with one of our attorneys, please leave your information below.Archives

July 2024

Categories

All

|

The Palmer Law Firmwww.thepalmerlawfirm.com

(c) 2024 Sean Y. Palmer |

DISCLAIMER:

This website is for educational and informational purposes only and is not, nor is it intended to be, legal advice. Viewing of this website does not create an attorney-client relationship. All legal matters should be discussed with a licensed attorney before you take any action. You should consult with an attorney for advice for your individual situation. Sean Y. Palmer is the attorney responsible for the content of this site. DATA NOTIFICATION: Pursuant to the Health Insurance Portability and Accountability Act, and the Texas Medical Records Privacy Act of the Texas Health and Safety Code, consumers are noticed that their protected healthcare information may be transmitted electronically. |

RSS Feed

RSS Feed